idaho state income tax capital gains

Taxes capital gains as income and the rate reaches 575. 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon your taxable income the first two.

State Income Tax Rates What They Are How They Work Nerdwallet

Idahogov Newsroom HelpSearch Idaho State Tax Commission.

. 1 If an individual taxpayer 11 reports a net capital gain in determining taxable income sixty one hundred 12 percent 6100 of the net capital gain from the sale or exchange of qualified 13. 1 If an individual taxpayer reports capital gain net income in. We last updated Idaho FORM CG in January 2022 from the Idaho State Tax Commission.

The corporate tax rate is now 6. You must complete Form CGto compute your Idaho capital gains deduction. Statement of Purpose Fiscal Impact.

For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income. Lower tax rates tax rebate. Idaho Income Tax Calculator 2021.

STATEMENT OF PURPOSE RS 11318 This bill will extend the Idaho capital gains deduction to corporations engaged in agriculture timber or mining. Additional State Capital Gains Tax Information for Idaho. More about the Idaho FORM CG.

Link to all our income tax guides and related information. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income.

The land in Utah cost 450000. This form is for income earned in tax year 2021 with tax returns due in. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

Analyze Portfolios For Upcoming Capital Gain Estimates. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Taxes capital gains as income and the rate reaches 660.

Idaho Statutes are updated to the web July 1 following the legislative session. In Idaho the uppermost. Idaho axes capital gains as income.

Idaho has reduced its income tax rates. If you make 70000 a year living in the region of Idaho USA you will be taxed 12366. CG - Idaho State Tax Capital Gains Deduction.

Deduction of capital gains. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. Therefore the taxpayers Idaho capital gains deduction is limited to the capital gain net income included in taxable income of two thousand five hundred dollars 2500 not sixty.

Idaho State Income Tax Forms for Tax Year 2021 Jan. Your average tax rate is 1198 and your marginal tax rate is 22. Mary must report 55000 of Idaho source income from the gain on the sale of the land computed.

Income Tax Idaho Code Title 63 Chapter 30. The land in Idaho originally cost 550000. For individual income tax the rates range from 1 to 6 and the number of.

Taxidahogovindrate For years.

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

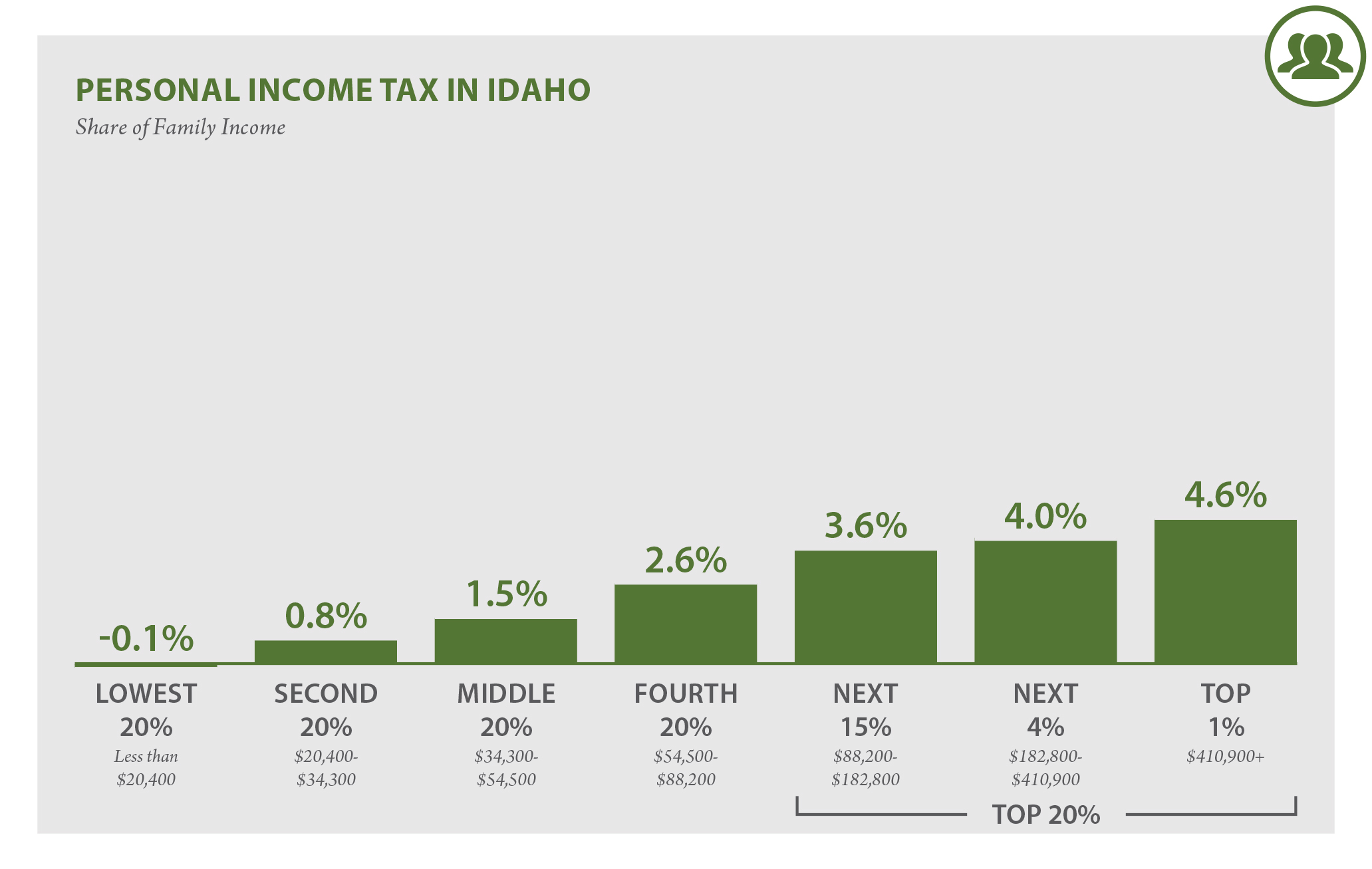

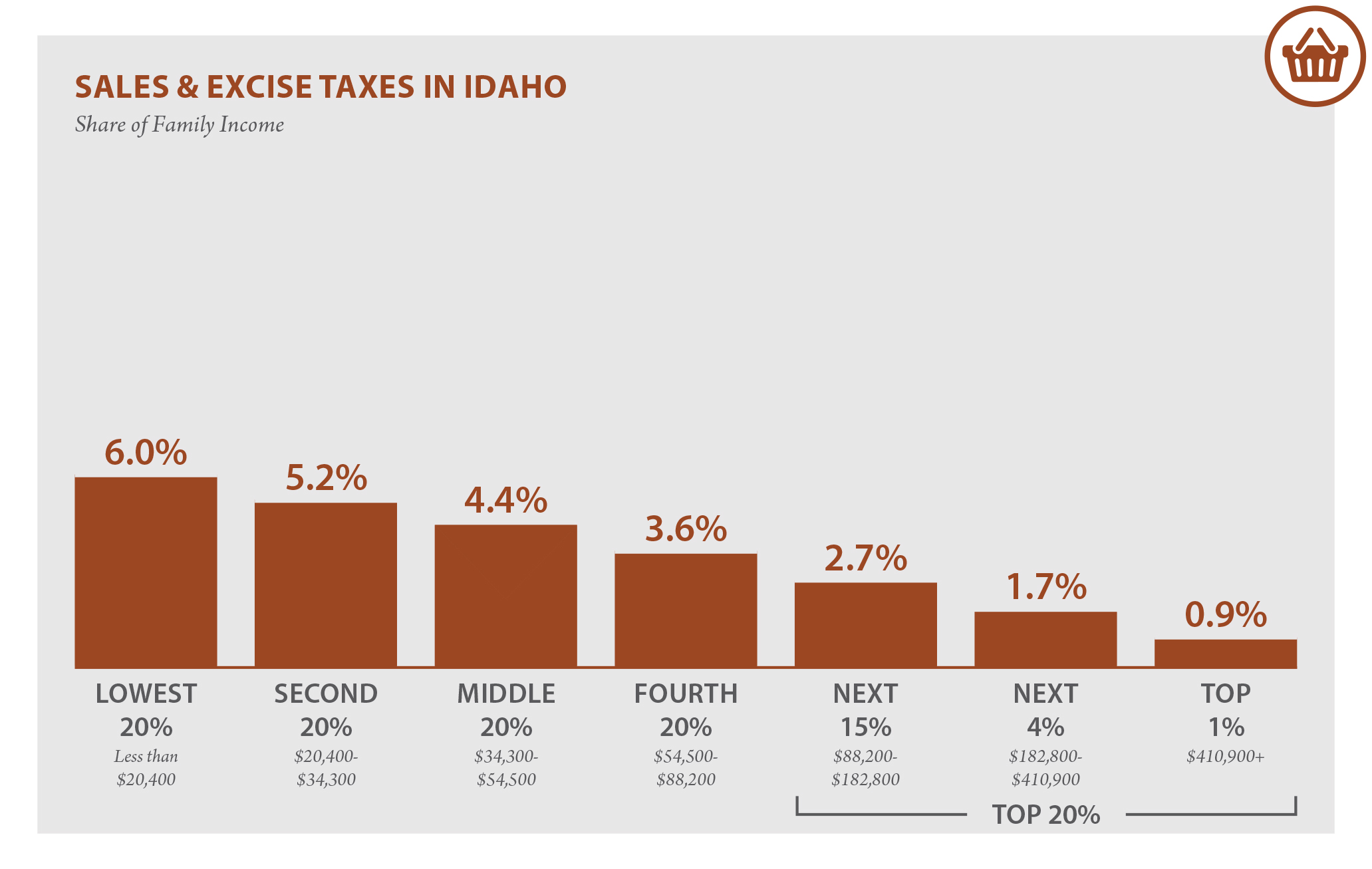

Idaho Who Pays 6th Edition Itep

Idaho 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Idaho Who Pays 6th Edition Itep

Individual Income Taxes Urban Institute

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Gold Silver Bullion Laws In Idaho

Cryptocurrency Taxes What To Know For 2021 Money

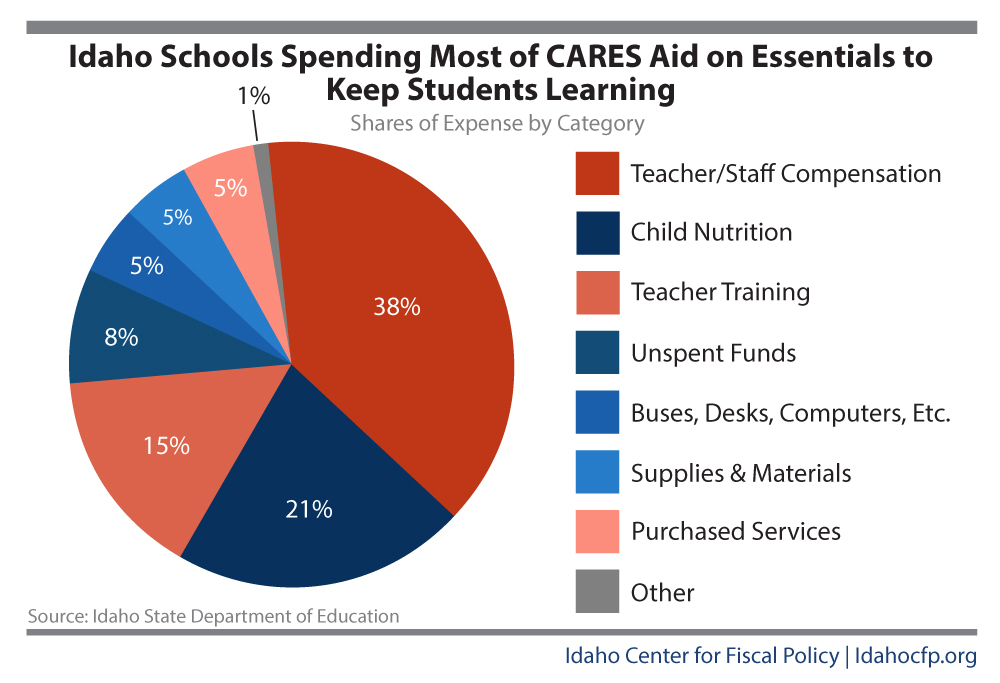

Idaho School Funding Long Term Challenges And Opportunities To Put Students First Idaho Center For Fiscal Policy

Historical Idaho Budget And Finance Information Ballotpedia

Lawsuit Filed To Block New Washington Capital Gains Tax Heraldnet Com

Idaho Tax Exempt Fund Saturna Capital

Idaho Doesn T Review Its Tax Exemptions Billions Go Uncollected Annually Report Says Idaho Capital Sun

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

Capital Gains Tax Idaho Can You Avoid It Selling A Home

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Idaho Retirement Tax Friendliness Smartasset

Idaho Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert